Beer Cartel, a prominent Australian craft beer retailer, just released the largest study of Australian craft beer drinking trends ever.

Receiving widespread support from both the public as well as the industry, the 2019 Australian Craft Beer Survey collected feedback from over 23,000 Australians this year, an increase of more than 5,000 online participants from 2018.

Here are some of this year’s key findings …

Balter has been voted Australia’s best craft brewery

For a second year in a row, consumers have chosen Balter as Australia’s best brewery followed by Bentspoke and Stone & Wood.

Launched by 6 Aussies, including surfing world champions Mick Fanning and Joel Parkinson, and a Yank in 2016, the Gold Coast brewery has captured the attention of Australian beer lovers and is riding that crest…

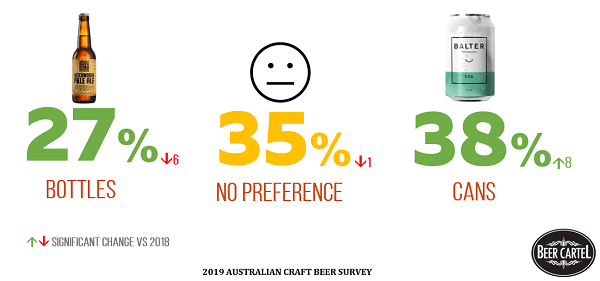

Preference for cans has overtaken bottles for the first time

Consumer preference for cans has surged in Australia, overtaking bottles for the first time in 2019.

Overall preference for cans has grown 8 percentage points to 38%, while preference for bottles decreased significantly to 27%.

This reflects the changing landscape of vessels in Australia where the majority of craft brewers now sell beer in cans.

Australia’s Craft Beer Demographics and Purchasing Behavior

This year’s study described the average Australian craft beer drinker as being 38-years old.

That consumer reported being interested in the craft beer segment for approximately 8 years and to spending an average of $56 on beer weekly.

And while the number of female craft beer fans has grown in 2019, female consumers only account for 23% of the action with 77% of beer drinkers being male.

Pale Ale/XPA was this year’s most popular beer style in Australia, followed by India Pale Ales and Double IPAs.

Australian craft beer consumers credit “friends and family” (49%) along with brewery staffers for influencing their beer choices.

Online beer purchases also grew in 2019. 30% of respondents reported buying beer online at least every six month, compared to 22% in 2018.

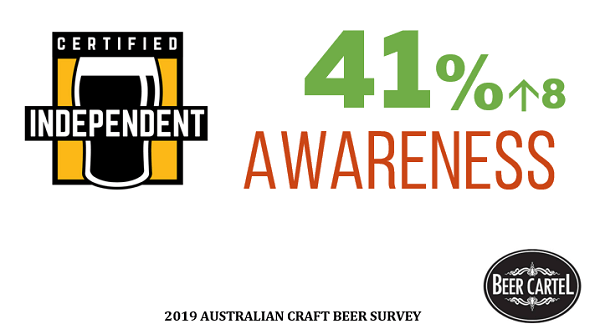

Awareness of the Independent Brewers Association Seal Grows

Mirroring actions taken by the Brewers Association in the US, Australia’s Independent Brewers Association introduced its own Independence Seal in May 2018. And awareness of that seal has grown from 33% in 2018 to 41% in 2019.

Nine percent of the online respondents said that they would only buy beer with the Independent Seal. But 59% reported that it had a “medium to large” impact on their beer purchasing choices.

And just as in the US, opinions differ as to how to approach craft breweries such as 4 Pines and Pirate Life which are now owned by large multinational brewers…

While 89% of respondents claimed to be big supporters of Australian craft beer, another 49% said that they were okay with buying ‘craft’ beer no matter who owns it.

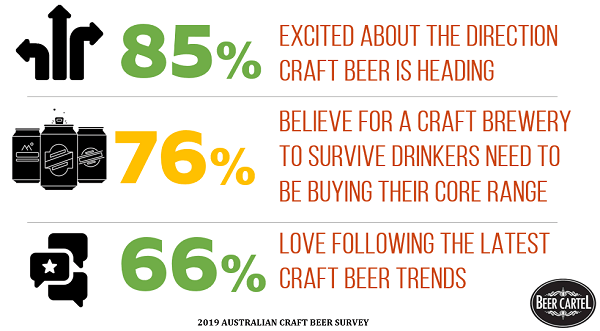

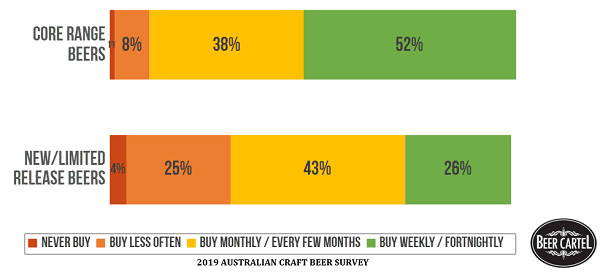

Core Range Beers account for the Majority of Craft Purchases

This finding was a bit of a departure from previous studies…

While previous Beer Cartel surveys showed a growing preference for one-offs and limited releases over core offerings, this year’s study reported that the Australian beer-buying public were embracing primarily flagship/core offerings.

And those core beers are purchased in greater quantities, primarily in 4 & 6 packs and case configurations, compared to new/limited release beers that are mainly purchased by the single or 4/6 pack.

Consumers were asked for the preference between 4 and 6 packs, as well as cases of 16 and 24.

Overall preference among Australian consumers was for 6 packs (68%) and cases of 24 (54%)…compared to their smaller alternative; 4 packs (38%) and cases of 16 (42%).

###

All image and chart credits: Beer Cartel

American Craft Beer The Best Craft Beer, Breweries, Bars, Brewpubs, Beer Stores, And Restaurants Serving Serious Beer.

American Craft Beer The Best Craft Beer, Breweries, Bars, Brewpubs, Beer Stores, And Restaurants Serving Serious Beer.