It’s no secret that many state governments are cash-strapped and in desperate need of revenue – and that they’re looking anywhere they can to raise it. The primary ways that a state or local government generates money is through property taxes, sales taxes and, of course, income taxes. But in addition to those “Big Three,” there are other and less obvious ways that governments use to raise revenue, and one of those ways is what’s commonly referred to as “sin taxes.”

A sin tax is described as a kind of sumptuary tax. Sumptuary taxes are ostensibly used for reducing transactions involving something that society considers undesirable. Common targets of sumptuary taxes are alcohol and tobacco, gambling, and vehicles emitting excessive pollutants. But just as society’s norms are constantly changing, so are the targets of its sin taxes. Increasingly, fast food and soft drinks are being discussed as sources for possible taxation. Colorado, which recently legalized the use of marijuana and is already taking steps towards its legal sale, is also having discussions about taxing it in the future.

Bottom line is that sin taxes are levied on activities that a society judges unfavorably, and it appears that drinking craft beer is one of those activities….

There are plenty of reasons why some people oppose sin taxes. Many suggest that they promote the growth of black market economies and lead to illicit activities such as smuggling. Others deem them regressive in nature and say that they unduly discriminate against the poor, but that’s a matter for a later discussion.

We just think that sin taxes are largely hypocritical. And while they are being sold as a way of promoting “healthier and more positive societal activities,” governments have themselves become addicted to, and more reliant on, the much-needed revenue that these taxes generate.

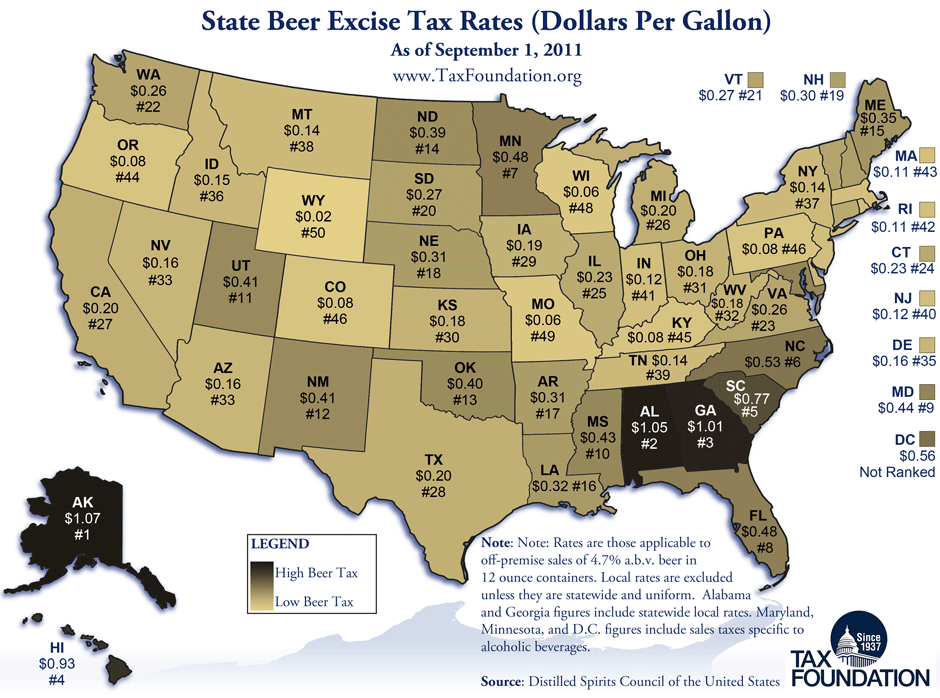

We think that sin taxes, left in the hands of local and state governments with bills to pay, can be a dangerous thing left unchecked. We also think sin taxes can allow governments, desperate for revenue, the power to impose undue hardships on small businesses like craft brewers all in the name of social propriety. As many of you know, profit margins for craft brewers can be extremely tight. Every expense factors deeply into a brewery’s ability to survive, especially in those first few years. Excise taxes vary widely from state to state and since they can add significantly to the price of the beer that you’re drinking, they should matter to you, just as much as they do to the craft brewers’ bottom line.

Our friends at the Motley Fool recently chronicled the states with the highest per gallon excise tax and we thought you might be interested.

Here’s their 5 States that Tax Beer the Hardest (gallon tax is based on the state’s per person consumption):

5) Hawaii – $0.93 per gallon

4) Georgia – $1.01 per gallon

3) Alabama – $1.05 per gallon

2) Alaska – $1.07 per gallon

1) Tennessee – $1.17 per gallon

Like we said, the best thing about a Sin Tax is its name….

American Craft Beer The Best Craft Beer, Breweries, Bars, Brewpubs, Beer Stores, And Restaurants Serving Serious Beer.

American Craft Beer The Best Craft Beer, Breweries, Bars, Brewpubs, Beer Stores, And Restaurants Serving Serious Beer.